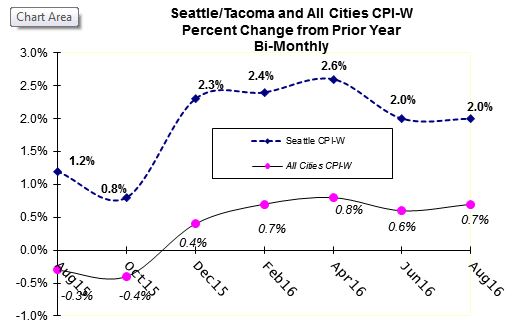

The recently released August CPI-W report shows the Seattle index continuing at the same level last report in the bi-monthly June report: 2.0%. As it has for some time, the All-Cities-W, as it has recently, continued to lag behind at 0.7%. This chart shows the two indices over the past 12 months:

As we have been indicating in our recent blogs on this topic, the strong economic growth in Seattle is contributing to its continued outpacing of the All-Cities CPI. As we have noted, this is part of a longer term advantage that the Seattle index has retained.

The Seattle index is likely the most used index for Washington labor contracts, followed by the All-Cities index. Here is the latest numbers on other indices commonly used:

| CPI INDEX* | CPI-W | CPI-U |

| All-Cities (Aug 2016) | 0.70% | 1.10% |

| Seattle (Aug 2016) | 2.00% | 2.10% |

| West Coast (Aug 2016) | 1.10% | 1.60% |

| West B/C (Aug 2016) | 0.60% | 0.70% |

| Portland (First Half 2016) | 1.20% | 1.70% |

These Seattle inflation numbers represent a bit of a drop off in the rate from earlier in the year. But they increase the likelihood that 2017 wage settlements on Washington public safety contracts will be at 2% or more. In some upcoming articles, we’ll provide a detailed report on current wage settlement trends.

**Please visit our Website for the most current CPI reports **